Blog

‘Google meets Which’: cost of living data platform Nous raises $9m

London-based fintech Nous has raised $9m (£6.6m) in a seed funding round to develop its platform for aggregating the cost of living data in areas such as energy, insurance and broadband.

Reimagining the future of buy-to-let. Why we invested in GetGround.

Real estate is the world’s largest asset class: UK buy-to-let alone is £1.2T. Yet it remains completely un-securitised and inefficiently managed. Individual investors often find themselves lacking a clear view of property yield, while having to manage an ever-changing landscape of regulations and tax laws.

Why We Invested in Lightyear

About a year ago, via our friend and co-investor Taavet Hinrikus, we learnt about a promising pair of ex-Wise (formerly TransferWise) executives who were under the radar, on a mission to democratise retail investment in Europe. At the time, in “stealth mode” the project was called Gandalf. As longtime consumer fintech geeks and Tolkien fans, we were doubly intrigued.

Why we invested in Zerion

Evgeny, Vadim, and Alexey have blown us away at every turn, with a powerful vision of creating the one-stop shop for DeFi. With a sharp eye for product and growth, they are rapidly bringing that vision to life.

The Potential of Real Time Trade Finance. Our investment in Hokodo

By now, most of us have used or been offered a buy-now-pay-later (BNPL) option when we shop online. BNPL not only makes checkout experiences faster, but also drives consumers to spend more money.

A second ‘DeFi Summer’? The next phase of Decentralised Finance

Decentralised finance – or DeFi – is gathering pace. After the ‘DeFi Summer’ of 2020, we’ve seen further growth in adoption this year. But is DeFi really moving towards the mainstream – and if it is, what are the second-order effects?

The year 2021 will bring DeFi into adolescence

After DeFi's breakout growth, we'll now see innovation in user experience, liquidity, scalability, and regulation.

Why we invested in Indeez

Gig workers have been hard hit by COVID. Freelance designers, Uber drivers, chefs and independent consultants alike have little visibility about when pre-pandemic life will return and their careers can resume. They were not protected against such a life-altering event: the crisis has been an awakening to the importance of income protection insurance.

Q&A with Habito's Daniel Hegarty

Daniel Hegarty, founder and CEO of our portfolio company Habito, came up with the idea for the business six years ago, after an eye-opening experience trying to buy his first home when his own mortgage broker made several frustrating mistakes. Dan realised that the mortgage market was rife with manual errors and confusing jargon.

Our Slush Workshop: A Fintech Founder's playbook for uncertain times

Our partner Toby had the chance to lead a workshop at Slush2020 on how FinTech founders can prepare for uncertain times.

Crypto protocols: in search of the emerging winners

We continue to witness a Cambrian explosion of public blockchain development. In recent years, the fabric of the decentralised web has begun to be woven, and the social contract of money is being rewritten. Bitcoin and later Ethereum are the two platforms on this movement was catalysed. In this post, we explore what comes next.

Balancing the books: the SME accounting opportunity

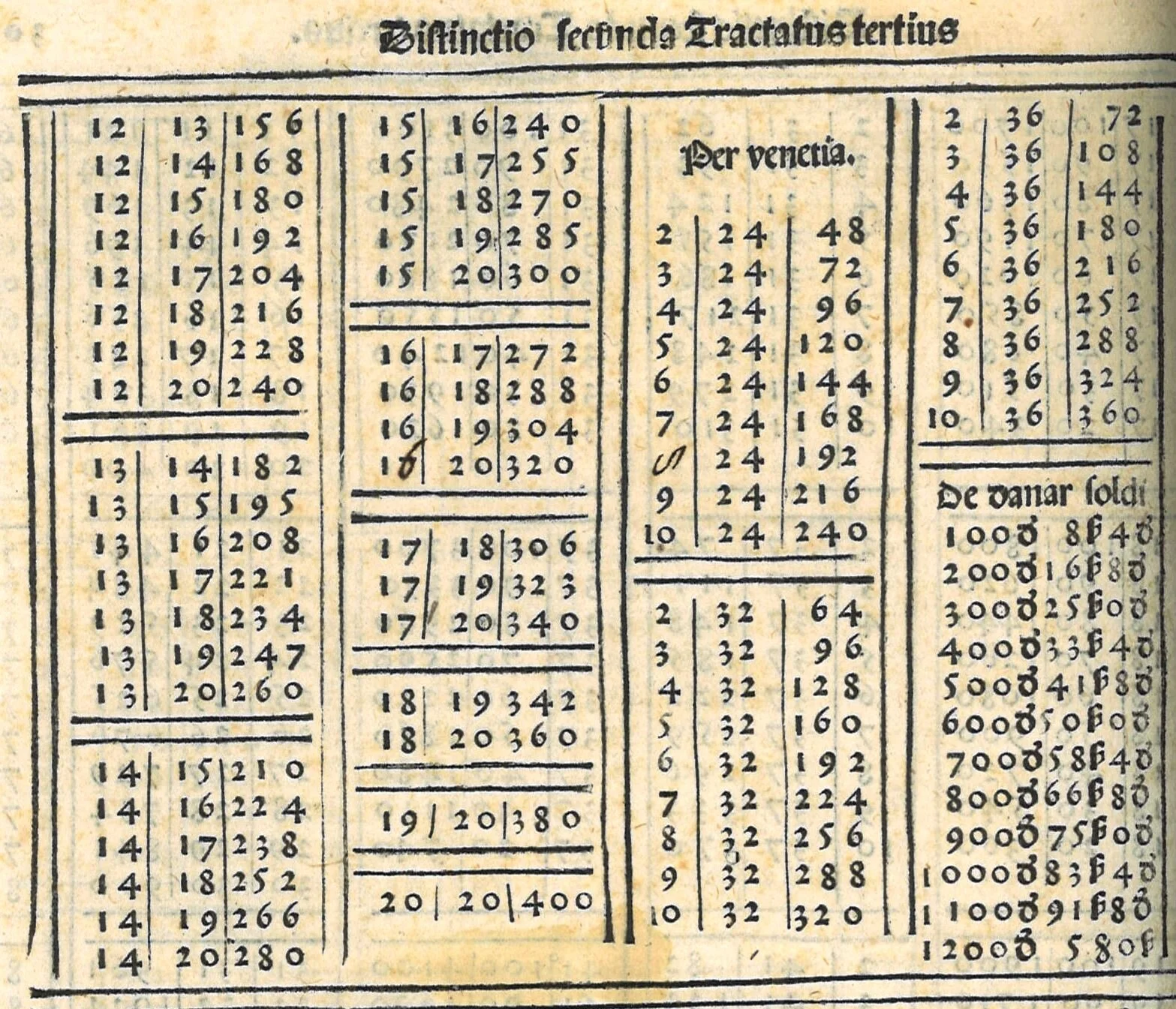

When Luca Pacioli first recorded the method of double-entry bookkeeping in the fifteenth century, he may not have anticipated the impact he would have on the modern world...

Rethinking retirement: the next generation of pensions

When reading about the state of retirement savings in Europe, one often encounters the journalistic trope of a 'time bomb'

Why we invested in Centrifuge - and a short love-letter to crypto in Berlin

Here at Mosaic, we have long been big believers in the power of decentralised infrastructure and applications, demonstrated by our past investment

Why we invested in Bonify

Co-Founders of Bonify: Dr. Gamal Moukabary , Dr. Josef Korte, Dr. Andreas Bermig, and Dr. Jan Ortmann

The Future of Mortgages

We wrote last April about the opportunity for habito to bring mortgages into the 21st century

Saving for retirement - can startups solve the pain points?

Fees are the first thing you should look at before choosing a pension manager and fund

Does the impact of the blockchain go beyond financial services?

At Mosaic we've long talked about what the killer applications of the Blockchain could be

Our Investment in Habito - bringing mortgages into the 21st century

We believe that trusted robo-advisors have a bright future